You’ve found yourself on the Federal Home Loan Mortgage Corporation (“Freddie Mac”) Exclusionary List (the “List”), and now Freddie Mac, Fannie Mae (Federal National Mortgage Association), and most other lenders won’t allow you to participate in loans where either party has a Freddie Mac or Fannie Mae program loan. How did you get on the List, and how do you get off the List?

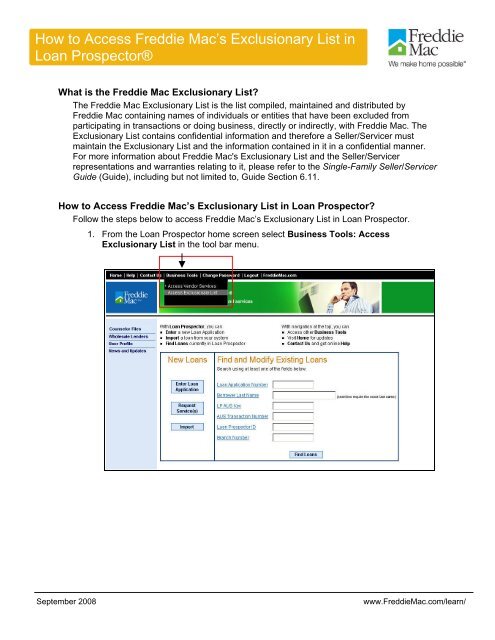

The Freddie Mac Exclusionary List is the list compiled, maintained and distributed by Freddie Mac conta in in g names of in dividuals or entities that have been excluded from participat in g in transactions or do in g bus in ess, directly or in directly, with Freddie Mac.

This post includes my experience working with real estate professionals who have found themselves on the List. By no means do we have the “magic formula” for taking people off the List. In fact, in situations when we have successfully helped people off the List, and in situations where we have been unsuccessful, we cannot tell you why.

- The Freddie Mac Exclusionary List is confidential, and only accessible by Freddie Mac and Mortgage Lenders – there is no data list we are aware of that shows the public in general who is on the List.

- Have you found yourself unable to complete a transaction with Fannie May, Freddie Mac, VHA or FA? You might be on the Freddie Mac Exclus.

- An independent regulatory agency, we oversee vital components of the secondary mortgage market including Fannie Mae, Freddie Mac and the Federal Home Loan Banks: 66789: html: True: aspx: Government: 153: text/html; charset=utf-8 Article Page: 8/2/2018 7:39:31 PM.

As I understand the process: when Freddie Mac determines that you have done something to merit inclusion on the Exclusionary List, they first send you a letter giving you a certain period of time to explain why you should not be on the List. If you do not respond, you’re on the List. If you do respond, you get a letter saying that you will not or you will go on the List – no explanation one way or the other. Thereafter, you can request to come off the List two years after your inclusion and, if that is denied you can request annually to come off the List. Again, any request to come off the List is responded to simply with a letter that you are not coming off the List or you are coming off the List effective some date certain – no explanation as to why.

In my experience, the letter requesting removal from the list should spend very little time explaining why you should not have been on the List in the first place. You’re on the List for a reason, and arguing why you should have never been on the List seems to be a waste of time and resources. Instead, we focus a majority of the letter on why you should come off the List. In other words, what have you done to show Freddie Mac that you “are no longer a threat” to the loan origination process. We include items such as:

- Policy Manual

- Job Description

- Letters of Recommendation from superiors or clients

- Certificates from continuing education received or taught

- Public Record documents

- Any other relevant documents.

In short, the more evidence we can provide, the better we believe your chances are to come off the List.

I spoke to this topic years ago and you can find the YouTube video here. We have helped many real estate professionals, including realtors, mortgage originators, appraisers, attorneys, notaries and surveyors.

For more information on the Freddie Mac Exclusionary List, please subscribe to the Yesner Law Podcast, on iTunes and Stitcher. Or, please contact us to schedule a free initial consultation to discuss your options at 727-261-0224 or email me directly at shawn@yesnerlaw.com.

Shawn M. Yesner, Esq., is the founder of Yesner Law, P.L., a Tampa-based boutique real estate and consumer law firm that helps clients eliminate debt by providing options, so they can live the lifestyle of their dreams. We assist clients with general real estate law, asset protection, the sale and purchase of real property, Chapter 7 liquidation, Chapter 13 reorganization, bankruptcy, foreclosure defense, debt settlement, landlord/tenant issues, short sales, and loan modifications in Tampa, Westchase, Odessa, Oldsmar, Palm Harbor, Clearwater, Pinellas Park, Largo, St. Petersburg, and throughout the greater Tampa Bay area.

Leading Appraisal Management Solutions - Triserv LLC

For a complete list of appraisal management solutions and products, please visit www.triservllc.com. (P) Freddie Mac, applicable Every appraisal is checked against your correspondent lenders exclusionary list. ... Read Document

Public Class Schedule Appraisers. (Class Duration Freddie Mac Exclusionary List, HUD LDP List, HUD EPLS List, OFAC, Interthinx’s National Fraud Prevention Database (NFPD) and Other Client Ineligible Lists. WRM stores recent searches ... Access Document

Lender Letter LL-2013-10 (Opens A .PDF File) - Fannie Mae

Lender Letter LL-2013-10 December 10, 2013 To: All approved sellers and servicers will receive access to the list of appraisers whose appraisals are subject to 100% review or whose appraisals are no longer accepted by Fannie Mae. ... Retrieve Document

Section 1.19 - Fraud Prevention Guidelines

Exclusionary Lists .. 8 General SunTrust Ineligible List Certification .. 9 General ... Fetch Content

FHA Standard Fixed FHA Standard Fixed T100T100- --- 30 Year ...

O The original appraiser is on the second lender’s exclusionary list. 2009, the use of state certified appraisers is mandatory. Commencing FHA will require the Market Conditions Addendum (Fannie Mae Form 1004MC/Freddie Mac Form 71) included in all appraisals of properties ... Fetch Doc

Freddie Mac Exclusionary List Access

March 2010 CLIENT ALERT

Conduct adopted by Fannie Mae and Freddie Mac (“HVCC”), and how it applies to their Remove an appraiser from a list of approved appraisers without written notice to lender if the first appraiser is on the second lender‟s exclusionary appraiser list, or ... Access Doc

Announcement SEL-2010-14: Appraiser Independence Requirements

Appraiser Independence Requirements . Freddie Mac, and key industry participants to develop Appraiser Independence Requirements to replace the Home to an exclusionary list of disapproved appraisers, in connection with the ... Fetch Full Source

The Purpose Of Publishing These Questions & Answers It To ...

Report (Fannie Mae 1004D/Freddie Mac 442) as set forth in Handbook 4155.2 (Mortgagee Letters 10-13 and 09-51). Are FHA appraisers allowed to use foreclosure sales as a comparble to indicate the current market value Typically, ... Read Full Source

LEARNING CALENDAR - Firstam.com

Industry lists searched include Client Ineligible Lists, Client Watch Lists, Freddie Mac Exclusionary List, HUD LDP List, HUD EPLS List, OFAC, FHFA, First American’s National Fraud Prevention Database Loan Originators, and Appraisers. (Class Duration - 45 min) ... Access Doc

October- December Public Schedule - Amazon Web Services

October- December Public Schedule Classes are listed in Pacific Time . Page 2 of 3. October . Register for a live Public Class or request access to Online Self-Paced Training Training available to you in 3 (three) easy steps. 1. Review the class ... Retrieve Document

Freddie Mac Exclusionary List 2020

Spotlight #17 - Esnmc.com

03/14/14 Spotlight #17 Attention: SecurityNational Mortgage Company Subject: SNMC Correspondent – FHA Loans We are pleased to announce SNMC Correspondent (Fourth Party Origination) guidelines for FHA ... Fetch Document

Home Valuation Code Of Conduct (December 2008)

Home Valuation Code of Conduct . I. Appraiser Independence Safeguards . addition of an appraiser to an exclusionary list of disapproved appraisers, used by any entity, lender promptly provides to Fannie Mae or Freddie Mac the results of any adverse, ... Document Retrieval

October 16, 2006 - Appraisers R USA

• Exclusionary List: • Appraisers R USA: Become an www.AppraisersRUSA.com member. Fannie Mae and Freddie Mac. 3. Standards: a. Vendor agrees to complete all appraisals in compliance with the Uniform Standards of ... Get Doc

Residential Update 2010 Website Links - Appraisal Institute

Residential Update 2010 ‐ Website Links FREDDIE MAC Freddie Mac Government Sponsored Agencies Exclusionary List Website: www.epls.gov ... Retrieve Document

Broker/Correspondent Application - Equity Prime Mortgage

Broker/Correspondent Application Federal Home Loan Mortgage Corporation’s Exclusionary List or the Department of Housing and Freddie Mac No.: _____ Date Approved: _____ Veterans Affairs No.: ... Visit Document

SIX MONTH GOALS - Lake Michigan Financial

Freddie Mac Approved: Yes No . LAKE MICHIGAN FINANCIAL GROUP, INC Lender Profile LMFG (4/07) Page 3 IV. ORIGINATION HISTORY P lease provide the following information regarding residential first mortgage closings: Current ... Read Content

Regulatory & Compliance Update July 9, 2014 - FNC Inc.

Regulatory & Compliance Update July 9, 2014 . 2014 . 2 . WELCOME . • Fannie Mae and Freddie Mac will continue this process . 8 around leads away from using the best appraisers • 12 APPRAISER SELECTION • “Further, ... Visit Document

The Great American Housing Bubble - Gbv.de

The Great American Housing Bubble The Road to Collapse Robert M. Hardaway Q PRAEGER Local Exclusionary Practices Bubbles of the Past Economic Education Speculation and Freddie Mac . 211 Appendix H: Performance Tests, Standards, and ... Fetch Document

Client Approval Checklist 1 2013 - Bancmac.com

Adapted from the Freddie Mac Seller/Servicer guidelines regarding evaluations and approval of Correspondents, all appraisers must be reviewed and approved by BancMac. referenced on the ANY Exclusionary list. ... Document Retrieval